The Tax Fraud battle in Georgia has been ongoing for more than 10 years. During that time, the Southeastern Carpenters focused on educating Georgia lawmakers about the harmful effects of Tax Fraud. Georgia lawmakers not only heard their message, but also virtually unanimously voted to enact an aggressive Tax Fraud law.

GA House Bill 389 is the Carpenters misclassification bill designed to level the playing field for all honest, law-abiding contractors, which, in turn, keeps Carpenters working.

The Southeastern Carpenters turned up the heat in the last five of this 10-year endeavor, successfully working with a Republican-majority House, Senate, and Governor’s office to lobby for support of HB389. Political Director Brett Hulme teamed with legislators to create the bill’s initial language and then increased knowledge about the tax fraud issue in Georgia through individual meetings.

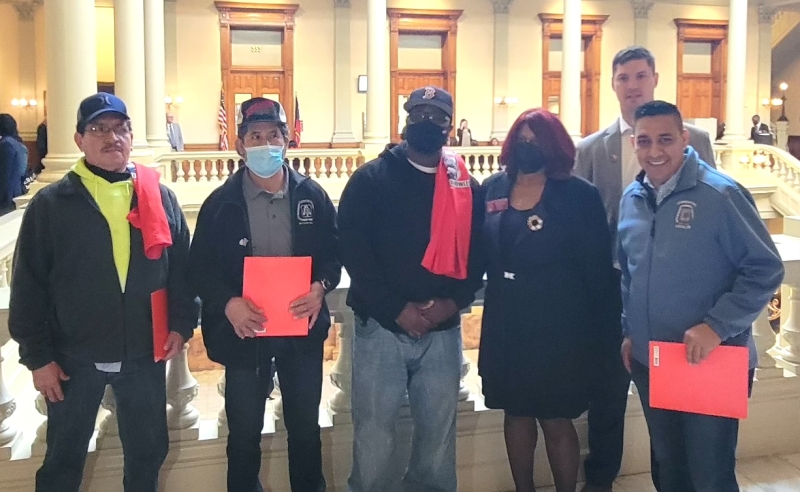

Atlanta carpenters met with legislators to explain benefits of HB389

Members from Atlanta Local 225, Savannah Local 256, and Augusta Local 283 held frequent in-person “Lobby Days” at the Georgia Capitol to educate legislators on the importance of HB389.

The latest version of the bill was introduced during Georgia’s 2021 Legislative session and carried over to the 2022 session. Georgia Carpenters continued to lobby legislators at crucial in-person “Lobby Days” in February. On March 1, the Georgia House passed HB389, 162-6.

WATCH COMMENTS BY REPUBLICAN STATE REPRESENTATIVE JESSIE PETREA (166TH District) TO SUPPORT HB389: https://youtu.be/mfZdQav8gcw

The Southeastern Carpenters launched a member email campaign to thank their representatives for supporting HB389. Another member email campaign was held the last week of the legislative session to Senators, encouraging support of HB389. On the last day of the session - meaning the last day for HB389 to remain in play - Georgia Senators passed the bill with revised language by a unanimous vote of 54-0. With just 25 minutes left before midnight on April 4, House legislators agreed to the Senate substitute language and passed the bill, 155-12.

On May 3, Governor Kemp signed HB389 into law which went into effect on July 1st 2022!

House Bill 389 helps stop employers from misclassifying workers as independent contractors rather than employees. The Georgia Department of Labor found more than 276,000 workers are misclassified in Georgia every year. By classifying a worker as an independent contractor, three harmful situations occur:

1. The employer avoids employee benefit costs, which exploits workers by denying them workers compensation and other protections, including the expectation of getting paid.

2. The employer avoids paying employee taxes. From 2016-2019, Georgia DOL audits found more than $275 million in lost revenue from uncollected taxes that cheating contractors avoided paying.

3. Contractors who commit tax fraud save enough money to submit 30% lower-priced bids on projects, which creates an uneven playing field against competing contractors who play within the law.

“HB 389 protects workers, levels the playing field for honest businesses, and makes everyone pay their fair share of taxes. We thank the Georgia House of Representatives, Georgia State Senators, and Governor Kemp for recognizing the need to fight Tax Fraud,” said Hulme.

“We also thank the years of hard work that our members contributed to help keep this Tax Fraud issue in front of legislators. Persistence and positivity paid off. Well done, brothers and sisters!”

Hulme said that the next step is to ensure enforcement of the law. The Council is supporting candidates in the November 2022 elections for Georgia Labor Commissioner and Attorney General, both of whom have committed to using HB389 to prosecute contractors who commit Tax Fraud.